Startups are synonymous with potential. For founders, employees, and investors, the appeal of creating or backing a successful startup lies in its capacity to generate outsized returns in a relatively short period. But what does success actually look like in financial terms? How much return can a successful startup generate in five years? To answer this, we must dive into the dynamics of startup growth, market conditions, and investment outcomes.

Defining “Success” in Startups

Before estimating returns, it’s essential to define what constitutes a “successful” startup. Success can vary depending on the perspective:

- Founders: Success might mean building a business that reaches a sustainable revenue level, exits via acquisition, or goes public.

- Investors: For venture capitalists or angel investors, success is measured by achieving a significant return on investment (ROI), typically in the range of 10x or more.

- Employees: Success can include financial windfalls from stock options or equity stakes.

For the purposes of this discussion, we’ll focus on startups that achieve rapid growth and provide substantial financial returns, often referred to as “unicorns” (startups valued at $1 billion or more).

Startup Growth Trajectory in 5 Years

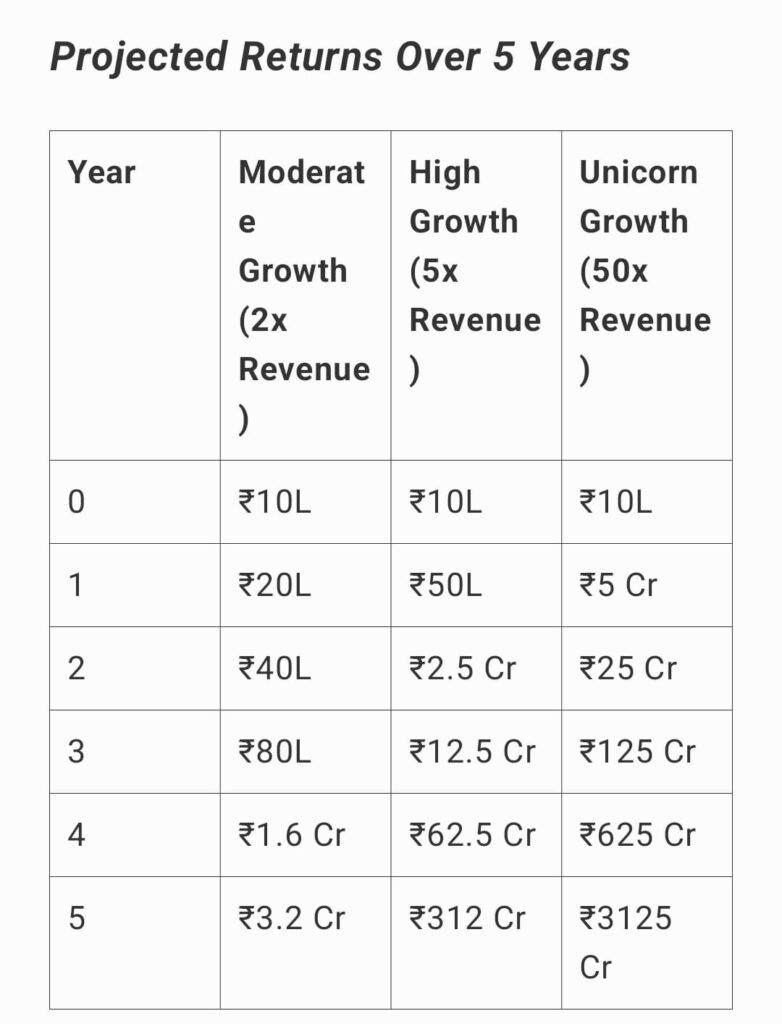

Startups that achieve success within five years usually follow an exponential growth curve. While most startups fail within their first few years, those that succeed tend to experience rapid revenue growth, increasing valuations, and market dominance. Here are the typical milestones:

- Year 1: Foundational work—building the product, acquiring initial customers, and possibly raising a seed round.

- Year 2-3: Scaling up—achieving product-market fit, growing the customer base, and raising Series A or B funding.

- Year 4-5: Rapid expansion—dominating the market, diversifying offerings, and potentially preparing for an exit (IPO or acquisition).

This growth trajectory is often reflected in the company’s valuation, which can increase dramatically during this time.

Understanding Returns for Investors

Early-Stage Investments

Investors who get in during the early stages of a startup—seed or Series A—stand to make the highest returns, but also take on the most risk. A successful startup could multiply its valuation several times over within five years, providing returns like:

- Seed Investors: Typically invest at a valuation of $1-5 million. If the company grows to a valuation of $1 billion (unicorn status) within five years, the ROI could exceed 100x for early investors.

- Series A Investors: Invest at a valuation of $10-20 million. A unicorn outcome could result in returns of 50x or more.

Later-Stage Investments

Investors coming in during Series C, D, or later stages often experience lower but still substantial returns. For example:

- Series C Investors: Might invest at a valuation of $100 million. If the company exits at $1 billion, the ROI is around 10x.

Real-World Examples of Startup Returns

- Instagram:

- Founded in 2010, Instagram was acquired by Facebook in 2012 for $1 billion.

- Early investors, who participated in Instagram’s $500,000 seed round, saw returns of over 100x within two years.

- Uber:

- Launched in 2009, Uber achieved a valuation of $50 billion by 2015.

- Early investors, like First Round Capital, earned returns exceeding 2,000x their initial investment.

- Airbnb:

- Founded in 2008, Airbnb reached a $30 billion valuation by 2016.

- Seed investors who entered at a $2.5 million valuation enjoyed returns of more than 10,000x over eight years.

While these are extraordinary examples, they highlight the potential upside of backing the right startup.

Returns for Founders and Employees

Founders

Founders typically retain significant equity in their companies. A founder with 20-30% equity in a startup that exits at $1 billion can walk away with $200-300 million before taxes. However, founders often dilute their stake during funding rounds, so final payouts depend on the amount of dilution and the exit valuation.

Employees

Employees with equity or stock options can also see substantial returns, though these depend on:

- The number of shares/options they hold.

- The company’s exit valuation.

- The terms of their equity grants (e.g., strike price and vesting schedules).

For example, an early employee with 0.5% equity in a startup that sells for $500 million could earn $2.5 million. However, this amount can be reduced by taxes and other factors.

Factors Influencing Startup Returns

- Market Size and Demand: Startups addressing large, rapidly growing markets have a better chance of achieving exponential growth. For example, tech sectors like AI, fintech, and health tech are currently hotbeds of startup activity.

- Execution and Leadership: The quality of the founding team and their ability to execute are critical. A strong team can pivot, adapt, and capitalize on opportunities, significantly increasing the odds of success.

- Timing and Luck: Timing plays a crucial role. Startups that launch at the right time in relation to market trends can grow faster. However, external factors like economic downturns or regulatory changes can impact returns.

- Investor Support: Startups backed by experienced investors and venture capital firms often benefit from mentorship, networking, and additional funding, increasing their chances of success.

The Risks

While the returns can be astronomical, it’s important to remember that the majority of startups fail. For every unicorn, there are dozens of startups that never reach profitability or fail to scale. Investors face the risk of losing their entire investment, while founders and employees might see their equity rendered worthless.

So, how much return can a successful startup generate in five years? For investors, returns can range from 10x to 100x or more, depending on the stage of investment and the eventual exit valuation. For founders, a successful exit can translate into hundreds of millions of dollars. Employees can also benefit significantly, though their payouts depend on equity terms and the company’s performance.

While the rewards are enticing, the road to startup success is fraught with challenges. Investors and founders must weigh the potential for life-changing returns against the inherent risks of the startup ecosystem. Ultimately, a combination of vision, execution, and a bit of luck is what turns a startup into a success story within five years.